Share post

Please enjoy this article on Understanding Art & Antique Valuations written by Kerry Hall here at Quastel Associates;

When one of our art, antiques and general valuers examines and values an item, there are several different values which they can attribute. This can be confusing to those not familiar with the valuation process and so we thought it would be useful to outline the different values which can be applied in this short article.

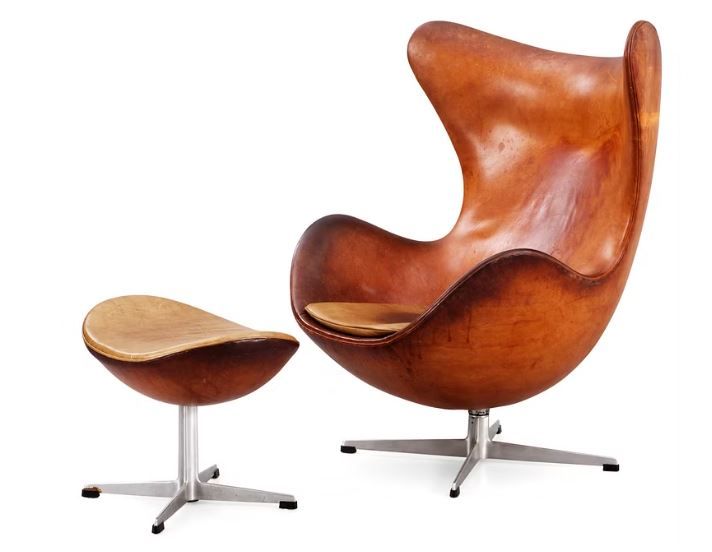

Firstly, let’s look at insurance valuations as these make up most of our valuations. Items valued for insurance are valued at “retail replacement”. By this we mean that if the item was stolen or damaged, what would it cost to go straight out and buy the same (or equivalent) item. For general contents, this can be straightforward as most known brands or shops will have similar items for sale. When it comes to artworks, this would mean a gallery price. Even if the artwork was initially purchased at auction, the item would be insured at a retail (gallery) replacement as that is where the item or comparable item can be purchased. Retail replacement can also include replacing items within the second-hand market as items such as pieces of antique furniture cannot be replaced like for like with a new piece.

Secondly, let’s examine auction valuations as this is another request from clients who wish to know the sale value or “open market” value of their items. This type of valuation gives the client a clear indication of what their items would achieve if sold at auction. What is important to note is that auction values are notably less than insurance values. When we refer to auction values, this means the hammer price plus the fees. The fees are usually 25% - 30% of the hammer price and consist of VAT, commission (auctioneers), artist resale rights (if applicable) and online bidding charges (if applicable). Sometimes a client will ask for the values to be given at mid or high auction estimate depending on their requirement for the valuation.

Lastly, lets discuss probate valuations. This is where a valuation is carried out when a person has passed away and the value of their contents needs to be provided to HMRC (for taxation purposes). Probate values follow the auction values discussed above and are the likely hammer price on the date of death. Again, the values are a fraction of that of an insurance valuation and importantly, the values must be applicable to the date of death to ensure the correct tax is paid. HMRC ask for items to be specified if they have a value of £1,500 or more and then the remaining items can then be grouped together. On probate valuations, items with no resale value will usually be included but stating NCV (No Commercial Value). This tells HMRC that the items existed but that they hold no value.

These are the most common three valuations that we carry out here at Quastel Associates. Of course, there can be slight variations and unusual cases but overall, the values attributed will fall into one of the above categories. On occasion clients request both an insurance and an auction (or “open market”) valuation to be carried out at the same time offering two reports; one to provide to their insurer to ensure they are correctly insured and one to keep on file for family distribution or the potential of selling certain pieces. Whatever the requirement for the valuation, our specialist valuers can assist.

To find out more about a valuation with Quastel Associates, please call 0207 253 1710 or click here.